2. The Three-Sector Economy:

In the circular flow model of three sector economy, government intervention has also been accounted for. But it is still assumed to be a closed economy, where the income flow is not influenced by any foreign sector.

IN three-sector economy there are three parties:

a) Household

b) Firms

c) Government

Here, there are two important components:

a. Injection: Injections are types of expenditure on goods and services that have any origin other than the household consumption. There are two types of injections:

The first one is called government purchases. This includes all purchases of goods made by all levels of government employees. Government purchases do not transfer payments like social security, disability payments or unemployment compensation. The sum of government purchases and transfer payments is called the government expenditure.

The second injection is investment. Investment is made up of two components. The first, fixed investment means purchases of newly produced capital goods- machinery, office equipments, construction of buildings used for business purposes, including construction of rental houses and so on. The second component, inventory investment means changes in stocks of finished goods ready for sale, stocks of raw material and stocks of partially completed goods in process of production. Inventory investment has a negative value if stocks of goods decrease in a given period.

b. Leakage: Instead of spending all of the income immediately on consumption, part of household income “leaks out” from the economy, which is called leakage. There are two types of leakages:

The first leakage is net taxes. This consists of tax revenues paid by households to government minus transfer payments received by households. Transfer payments mean government payment like pension, retirement benefits, disability payments, temporary needs to needy families and so on.

The second leakage is saving. Saving is the part of domestic income that is not used by households to purchase household goods or pay taxes.

Now let’s get back to the circular flow of income in three-sector economy. Firstly household sector pays income tax and commodity tax to the government, On the other hand, government also makes transfer payments to the household sector.

Income and expenditure flow between government sectors is similar. Business firms pay taxes to the government, the government on the other hand pays subsidies and makes transfer payment, and pays from goods and services it purchases from the business sector.

Taxes paid by the household and business sector are the leakages form the circular flow. This decreases not only the consumption savings of the household sector but also decreases investment and production of business sector.

Flow Chart of Three –Sector Economy

Flow chart of three sector economy

However, the government offsets the leakage by buying services from the household sector, and goods and services form the business sector. This leads to equilibrium in the circular flow as the level of income meets the level of supply in the economy. A part of the income earned by the government is saved and deposited in the capital market. Government also takes loan from the capital market.

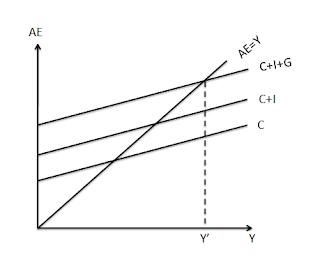

EQUATION:

Aggregate Demand = C + I + G [where, C = consumption; I = investment; G= government expenditure]

Aggregate Supply = C + S + T [where, C = consumption; S= saving; T= tax]

As we know,

Aggregate Demand = Aggregate Supply

Or, C + I + G= C + S + T

Or, C + I + G= C + S + T-R

Or, S – I = (G+R) – T

If government spends all its income received in the form of taxes, it flows back to the household and business sector in the form of subsidies and others. This leads to the continuous circular flow of national income within the economy.

perfect! thanks for this. just a suggestion...add financial markets in the flow diagram of 3 sector model.

ReplyDelete